About 'accounts payable information'|... on every facet of debt collection - mailing procedures, all accounts payable & receivables, payroll, filing, further search ...

Accounting information summarizes the financial condition of a business and provides insight about successes and shortcomings. This is accomplished by using double-entry bookkeeping. Understanding this system opens the door to examining accounting reports. Double-entry bookkeeping is based upon an equation stating that Assets minus Liabilities equals Net Worth. Every accounting entry affects accounts within these categories so that the equation remains in balance. Each account is a ledger page. All of the ledgers combined comprise the General Ledger. When the ledger balance for an asset account increases, another asset ledger balance must decrease or the balance of a liability must increase or a net worth account must decrease. To perform the simple exercises required to understand accounting information, gather these accounting reports: Balance Sheet dated today Year-to-Date Income Statement (also known as the Profit & Loss or P&L) Year-to-Date General Ledger report Locate the net worth (or "equity") accounts at the bottom of the balance sheet. One of the accounts is the year-to-date profit. This matches the profit on the year-to-date P&L. Profit is therefore a component of net worth. Since the P&L calculates profit as revenue minus expenses, net worth is increased by revenue and decreased by expenses. Profits increase Net Worth. Select a bank account from the assets listed on the Balance Sheet. Locate the ledger for that account on the General Ledger report. Find a transaction on the bank account ledger representing an increase in the bank account. There is an equal offsetting amount on another ledger. If the bank deposit was an amount owed by a customer, there is a decrease in accounts receivable'"a different asset account. If this deposit was from a cash-paying customer, there is an increase in revenue'"thereby increasing profit and thus net worth. If the deposit is loan proceeds, there is an increase in loans payable'"a liability account. Write the effect of the transaction using the equation of Assets minus Liabilities equals Net Worth. For example, a deposit of $100 in cash sales to the bank account results in: $100 - 0 = $100 The first $100 is the change in the bank account asset, the zero is the effect on liabilities in this transaction, and the last $100 is the change in net worth caused by the revenue increasing profit. Find on the bank account ledger a check transaction representing a decrease in the bank account. There is an equal offsetting amount on another ledger. If the check paid an outstanding bill, there is a decrease in accounts payable'"a liability account. If the check was for a cash purchase, there is an increase in some expense account'"thereby decreasing profit and thus net worth. If the check paid a loan, there is a decrease in loans payable'"a liability account. Write the effect of the transaction using the equation of Assets minus Liabilities equals Net Worth. For example, a check for $100 to pay a bill in accounts payable results in: -$100 '" (-$100) = $0 The first $100 is a negative for the change in the bank account asset, the next negative $100 is the reduction in the accounts payable liability account, and the zero is the effect on net worth. Record the effects on the double-entry bookkeeping equation for various types of transactions. For example, a $100 sale on credit increases the accounts receivable asset account and also increases net worth (due to the revenue increase causing a rise in profit). The equation is: $100 '" 0 = $100 Observe how revenue and expenses affect the equation of Assets minus Liabilities equals Net Worth. Despite the P&L having details about revenue and expenses, the effect of revenue and expenses on the equation is the change in net worth. Therefore, think of net worth as comprising revenue minus expenses. Net worth rises when revenue is received and falls when expenses are paid. One final tip: there may be an increase or decrease in several accounts that equal the increase or decrease in only one other account. But every accounting transaction keeps the double-entry bookkeeping equation in balance. After a little practice of understanding the sequence that creates accounting records, evaluation of reports is simplified. |

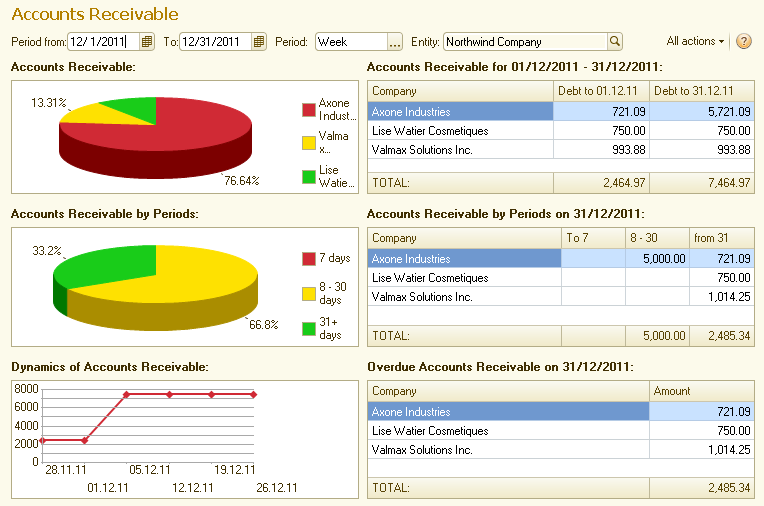

Image of accounts payable information

accounts payable information Image 1

accounts payable information Image 2

accounts payable information Image 3

accounts payable information Image 4

accounts payable information Image 5

Related blog with accounts payable information

- nerdsofobiee.wordpress.com/...This table stores the accounts payable aging information at the invoice and association dimension...include Company, Supplier, Supplier account, Transaction type, etc. ...

- debtcollectorsanon.blogspot.com/... on every facet of debt collection - mailing procedures, all accounts payable & receivables, payroll, filing, further search ...

- accountingtutorial.wordpress.com/...any price changes and duplication of invoices. More Valuable information about Accounts Payable Tutorial within the context of Simply Accounting software can be ...

- ivythesis.typepad.com/term_paper_topics/...uncertainty, then managing the accounting information would be difficult. Furthermore, a... and short-term payables as well as the firm’s current...

- frontlinesource2444.wordpress.com/...Group is one of the fastest growing Information Technology, Accounting, Legal, Human Resources, Administrative, and Clerical staffing...

- frontlinesource2444.wordpress.com/...2-5 years experience in Accounts Payable Must have experience with 3-way match...the fastest growing Information Technology, Accounting, Legal...

- frontlinesource2444.wordpress.com/...Temporary E&P Accounts Payable Specialist . Job Description: ..., administrative support, account reconciliations... growing Information Technology, Accounting...

- frontlinesource2444.wordpress.com/...applicable accounts payable/general ledger systems..., financial chart of accounts and corporate procedures... growing Information Technology, Accounting...

- investingessentials.blogspot.com/... by the taxes payable on dividend and capital ...89 in a tax-deferred account, a taxable account would have... by 57.5%." The above information demonstrates the...

- bellmobilityisascam.blogspot.com/...s new cancelling policy is as follows: Cancellation Fee: The fee payable by you if your service is terminated before the expiry of your Term of...

Related Video with accounts payable information

accounts payable information Video 1

accounts payable information Video 2

accounts payable information Video 3

0 개의 댓글:

댓글 쓰기